The operator of the Web page just isn't a lender and would not make loans or credit score conclusions. This Internet site will not represent a proposal or solicitation to lend or provide funding. This website will post the data you give to a number of funding companions.

Pay back Debt: Reducing your Over-all debt load can enhance your credit history rating. Concentrate on shelling out off superior-fascination debts or consolidating them into more workable loans.

Given that We have now a standard knowledge of credit scores, Allow’s dive further into what a 710 credit score rating signifies and how it may impact your money journey.

Most vehicle lenders will lend to somebody with a 710 rating. Even so, if you'd like to ensure you qualify for your vehicle bank loan at the best interest charges, you'll want to proceed enhancing your credit score.

Examine credit rating rating on a regular basis: One of A very powerful techniques to boost your credit history rating is to track it. Keep an eye on your credit history rating Any time possible, but be sure you don’t get it done too often or else it could carry the rating down.

You'll be able to Examine customized personal mortgage provides from multiple online lenders atAcorn Finance. You may as well Test delivers from neighborhood banking institutions and credit unions if you want. Be careful allowing various economic establishments to tug your credit history however, this will affect your score. At Acorn Finance you may Examine own financial loan provides without credit affect.

Although borrowing revenue may well offset money tension for the time being, it may create extra pressure down the road. We nevertheless really encourage you to borrow money if it can advantage you but just weigh the pros and cons of your situation before doing this. What do lenders take into consideration when assessing a potential borrower that has a 710 credit history rating?

Approval for Certain Loans: Although a 710 credit score rating is considered great, it is probably not adequate to qualify for particular different types of loans with strict credit history prerequisites. Such as, some lenders may possibly have to have bigger credit rating scores for specialised loans or more competitive curiosity premiums.

Despite the fact that a 710 credit rating score is taken into account great, there is usually area for enhancement. By applying some vital methods, it is possible to get the job done towards getting a fair larger credit history rating. Below are a few tips about how to further improve a 710 credit rating score:

Step 2: The lender will then Exhibit mortgage costs, terms and conditions. You may then have the choice to simply accept or decline the limited-time period mortgage you are offered. The bank loan Won't be is issued right until you accept and digitally sign to the mortgage software and phrases.

Terms and conditions change and they are only offered after you entire an software and are matched having a lender from our network. Think of us as the simplest way to discover lenders that in good shape you finest!

We wish to reiterate that Moneycontrol won't solicit money from traders and neither does it guarantee any certain returns. In the event you are approached by any one making this sort of statements, remember to publish to us at grievanceofficer@nw18.com or simply call on 02268882347

Last of all, once you've observed the provide you need to take, you'll click here need to finalize the acceptance. This will likely require distributing spend stubs or every other stipulations asked for via the lender.

It’s greatest to stay away from payday loans and superior-curiosity personal loans, since they produce extensive-phrase personal debt difficulties and just add to an extra decline in credit rating rating.

Jennifer Love Hewitt Then & Now!

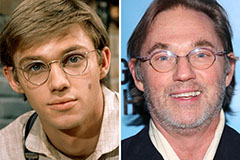

Jennifer Love Hewitt Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!